Business Rationale

The Issue:

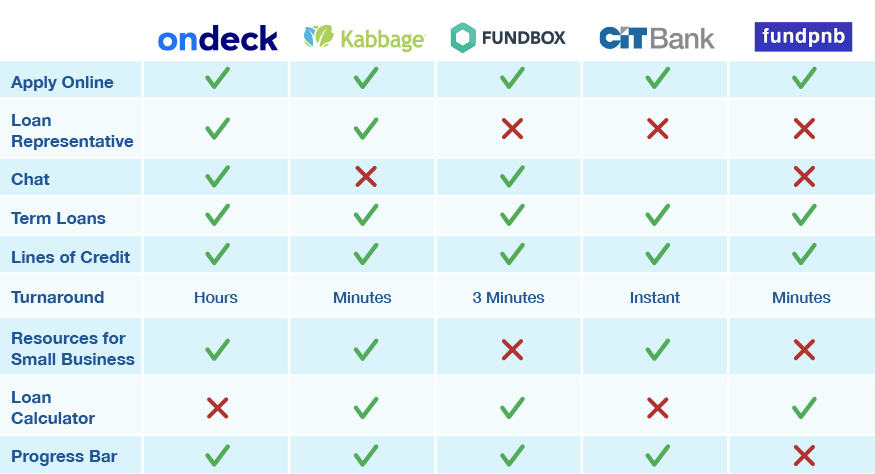

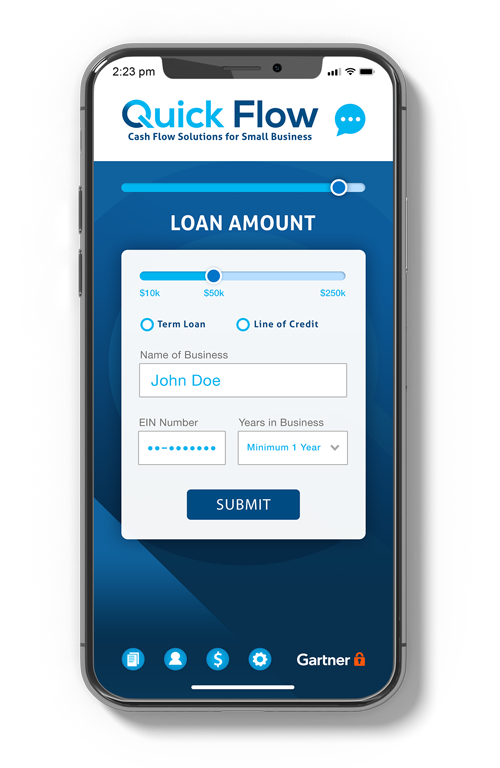

Quick Flow is a private lender that specializes in servicing small businesses with lines of credit and term loans. Many small businesses often run into situations where in order to grow they must take on projects that exceed their existing resources. Based on the research conducted, small businesses need a quick and efficient method to apply for loans.

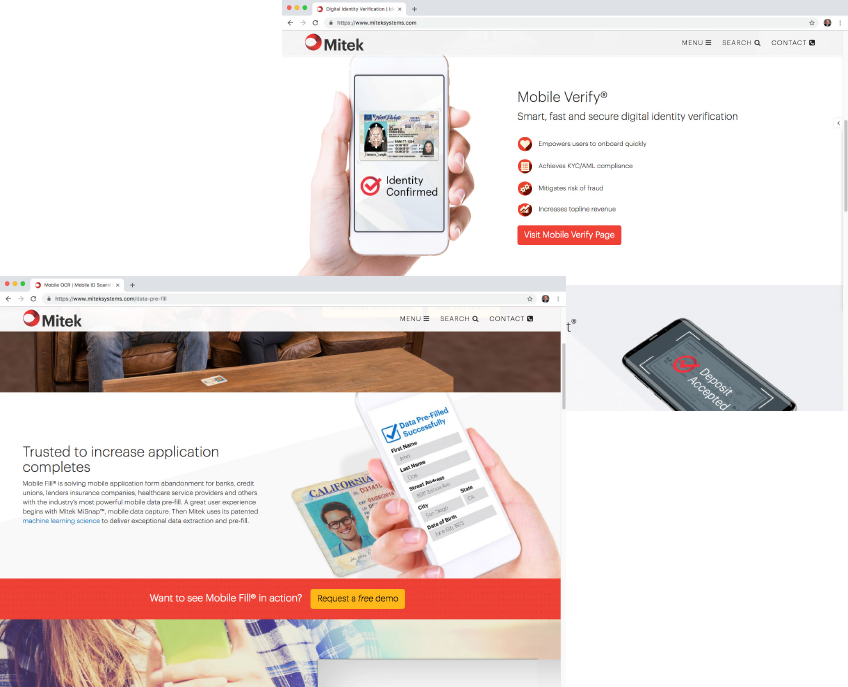

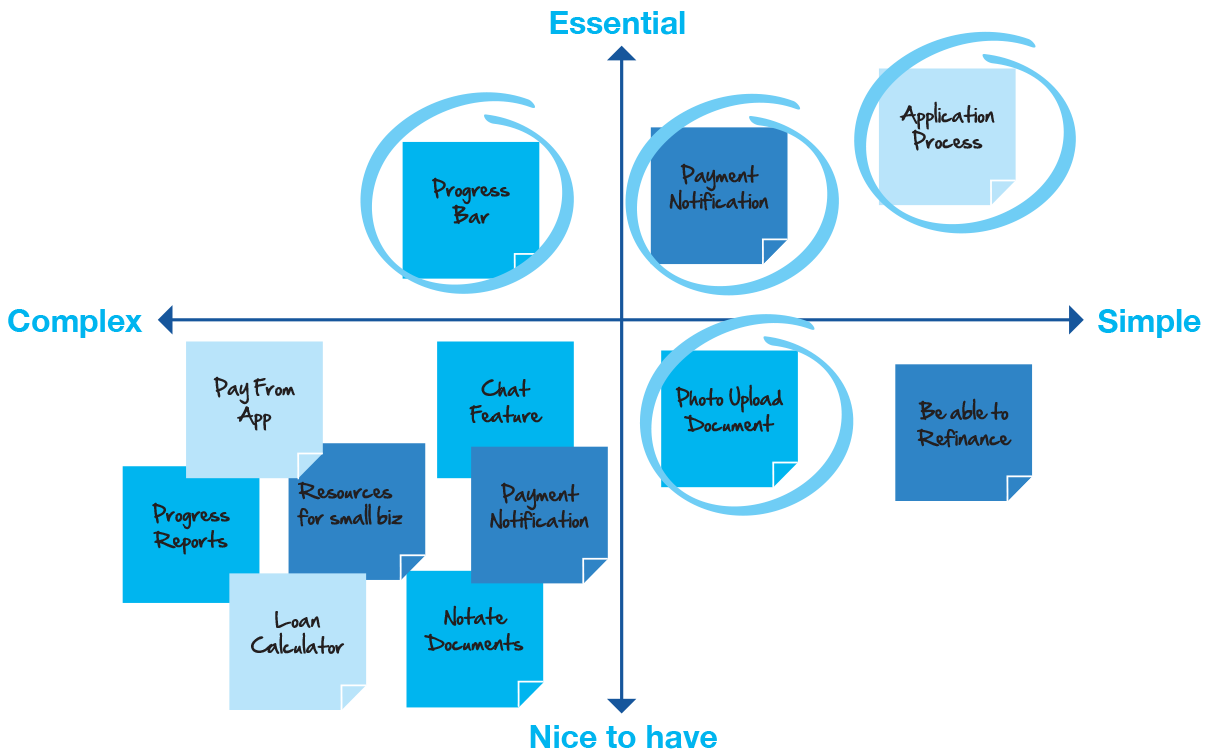

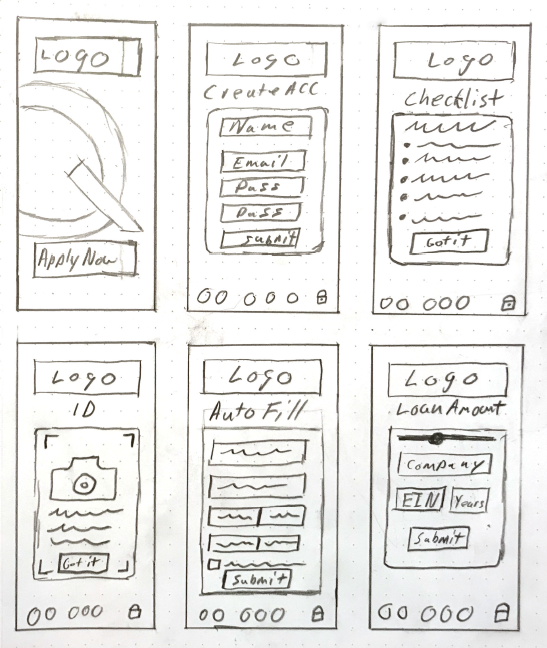

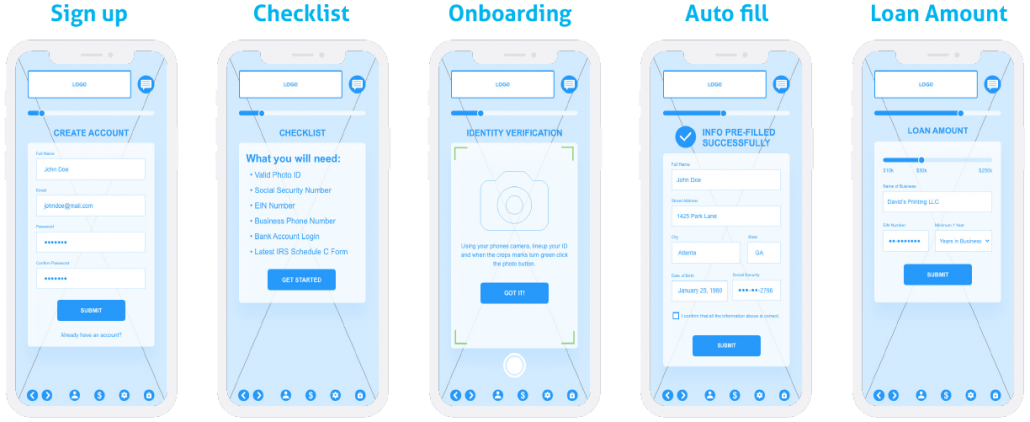

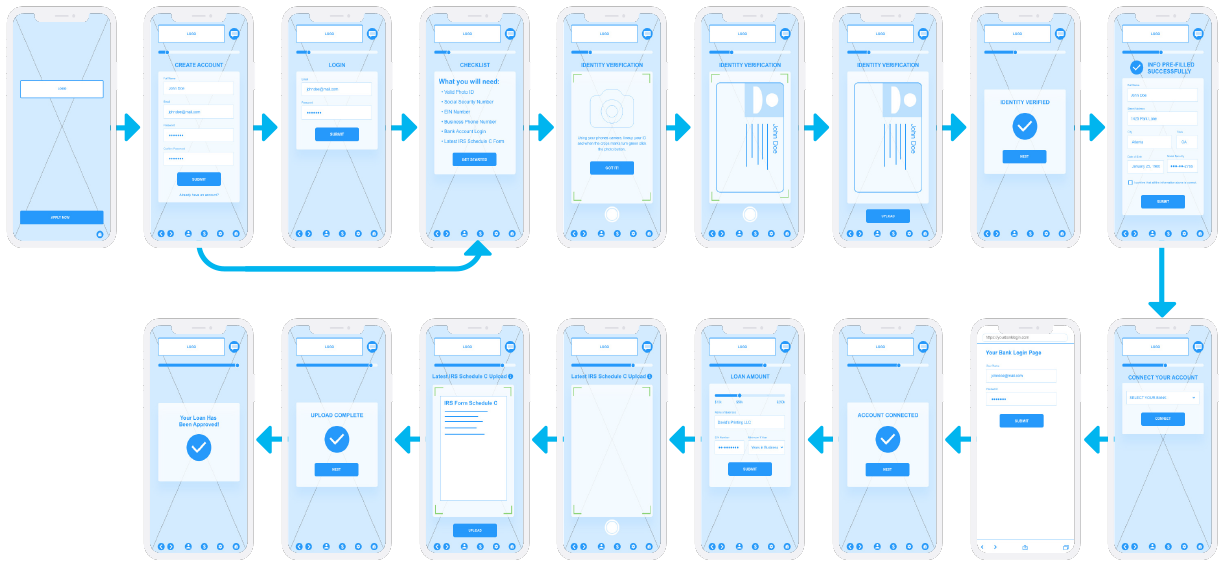

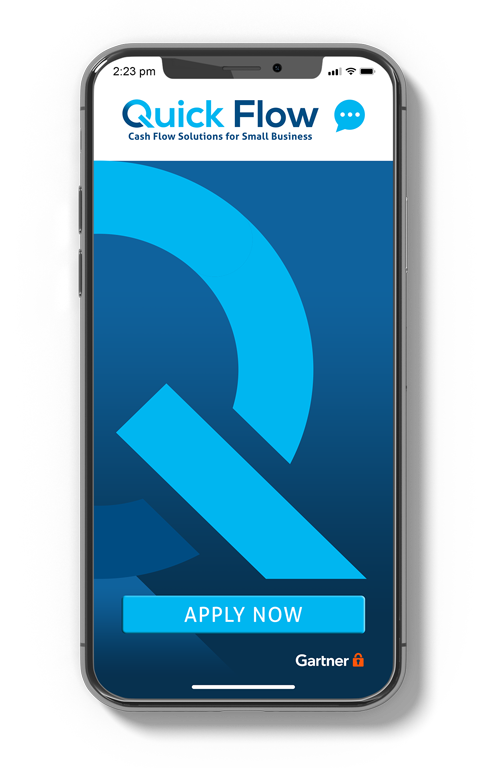

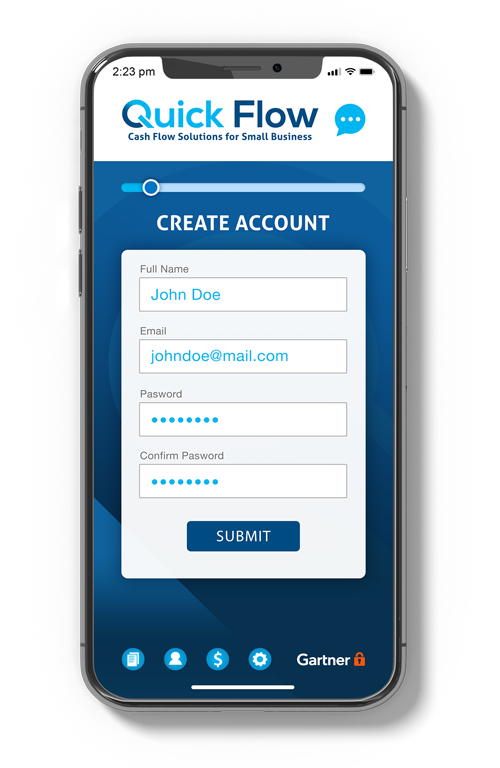

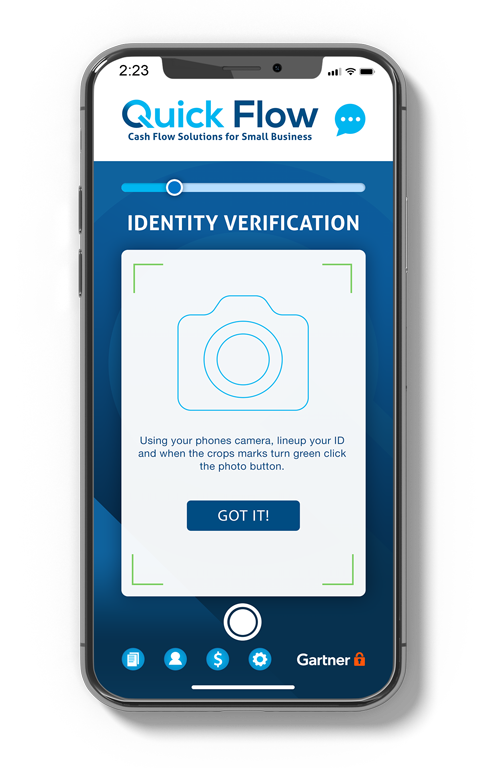

Our Solution:

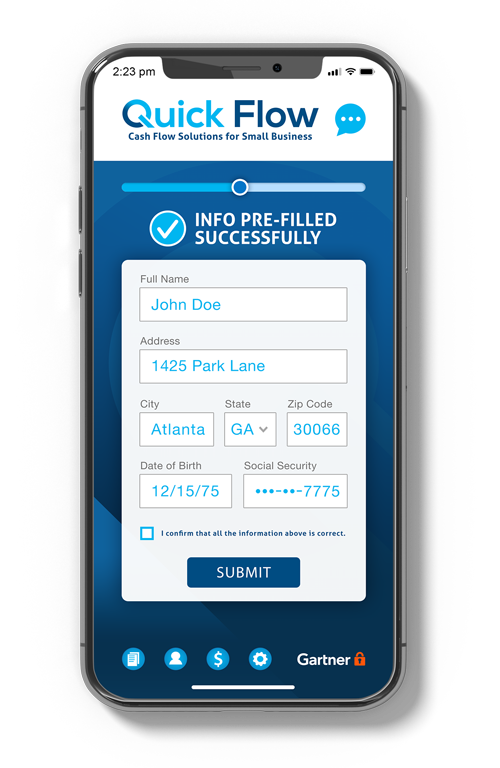

We intend to provide small business owners with a quick and efficient app that will quickly assess the viability of obtaining a term loan or line of credit. After the initial assessment, the app will guide users through the process step by step. Approved users will have access to statements and have the ability to pay installments through the app.